Bitcoin Long-Term Holders Signal Patience in Market

2025-07-04 12:22:35

Main Idea

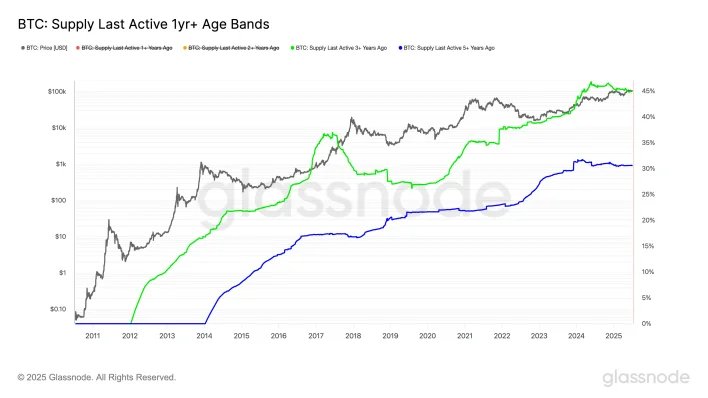

Long-term Bitcoin holders are showing patience in the market, with a significant portion of supply remaining unmoved for years, indicating potential higher price targets despite recent market conditions.

Key Points

1. Roughly 45% of Bitcoin supply hasn’t moved in at least three years, the same level as February 2024.

2. Five-year unmoved supply is stable at 30% since May 2024.

3. Long-term holders (LTHs) are defined as investors who hold Bitcoin for extended periods, showing conviction in the asset.

4. The market was in a leverage crisis in July 2022, triggered by the collapse of 3AC and Celsius, with Bitcoin priced at $20,000 at that time.

Description

According to Glassnode, long-term holders (LTHs) are defined as investors who have held bitcoin (BTC) for at least 155 days. CoinDesk Research indicates that one reason bitcoin has ye to reach new all-time highs has been selling pressure from these long-term holders. However, zooming out, Glassnode data shows that the percentage of bitcoin’s circulating supply that has not moved in at least three years currently stands at 45%, which is the same level observed in February 2024, one month after th...

Latest News

- PEPE Slips 6% as Whales Load Up, Technicals Hint at Possible Bounce Amid Market Jitters2025-07-04 12:22:47

- Bitcoin Long-Term Holders Signal Patience in Market2025-07-04 12:22:35

- Coinbase's Base Sees Over $4B in Capital Outflows Through Cross-Chain Bridges; Ethereum Registers Inflows of $8.5B2025-07-04 12:19:45

- Bitcoin on the Brink of All-Time High as Macro Tailwinds Gather Strength2025-07-04 11:18:22

- JD.com, Ant Group Push for Yuan-Based Stablecoins to Counter Dollar Rule: Reuters2025-07-04 11:18:06