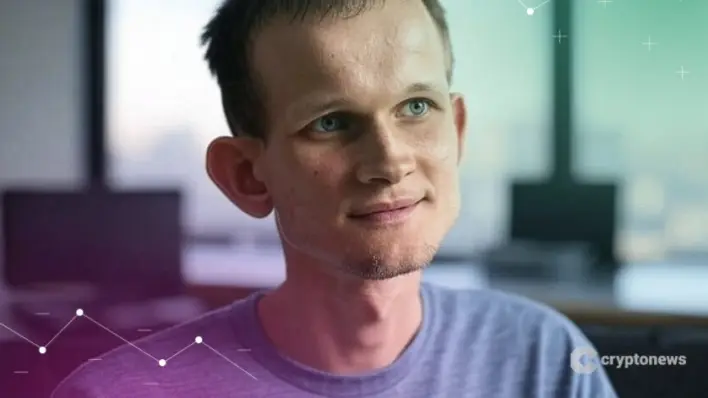

Vitalik Warns Corporate ETH Treasuries Could Become ‘Overleveraged Game’ Despite Benefits

Main Idea

Vitalik Buterin warns that corporate ETH treasuries could become overleveraged, risking severe market crashes, as 64 entities hold 3.04M ETH worth $11.88B.

Key Points

1. Vitalik Buterin acknowledges benefits of corporate ETH adoption but warns of overleveraging risks, citing potential 90% market crashes due to forced liquidations.

2. 64 entities currently hold 3.04 million ETH worth $11.88 billion, raising concerns about market concentration and liquidity risks.

3. Historical examples like the 2008 financial crisis and 2023 banking turmoil illustrate how quickly liquidity can evaporate during market stress.

4. VanEck's Matthew Sigel warns Bitcoin treasury strategies could backfire, with firms nearing net asset value (NAV) risking shareholder value erosion.

5. MicroStrategy's dominance in Bitcoin holdings has led to copycat strategies, but concerns arise about long-term sustainability and potential 'death spirals'.

Description

Ethereum co-founder Vitalik Buterin has issued a stark warning about the growing trend of companies holding ETH in their treasuries, cautioning that the strategy could evolve into an “ overleveraged game ” that triggers massive market liquidations. His comments come as corporations rush to add cryptocurrencies to their balance sheets, with 64 entities now holding 3.04 million ETH worth $11.88 billion. Ethereum Founder Balances Benefits Against Overleveraging Risks Buterin acknowledged the benefi...

Latest News

- Ethereum Foundation Backs Tornado Cash Developer with $500K Legal Defense Fund2025-08-08 12:51:36

- China Orders Brokers to Halt Stablecoin Promotion Amid Risk Concerns2025-08-08 11:44:28

- Capriole Founder Says Bitcoin’s ‘Energy Value’ Puts Price at $167.8K2025-08-08 11:22:48

- FTC: Imposter Scam Losses Among Seniors Surge 362% Since 20202025-08-08 10:45:51

- Animoca, Standard Chartered, HKT Form Anchorpoint for Hong Kong Stablecoin License2025-08-08 10:02:42