US Regulators Suggest Banks Could Custody Bitcoin Under Strict Consumer Protection Rules

2025-07-14 22:06:28

Main Idea

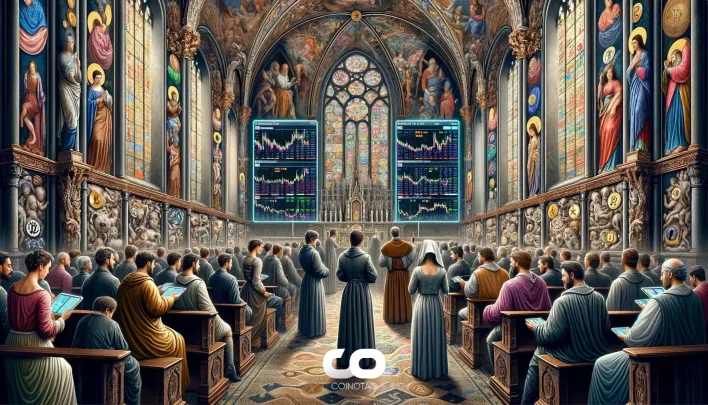

US regulators have clarified that banks can custody Bitcoin under strict consumer protection and risk management frameworks, signaling a shift towards integrating crypto services with traditional finance.

Key Points

1. The OCC, FDIC, and Federal Reserve jointly stated that banks can engage in cryptocurrency custody, provided they adhere to existing risk management and legal standards.

2. Regulators emphasize the need for robust security and consumer protection measures in crypto custody services.

3. The move aims to reduce regulatory uncertainty and reputational risks that previously deterred banks from deeper involvement with crypto assets.

4. Clear legal frameworks for crypto custody may encourage institutional investors by reducing risks related to loss or theft.

5. The regulatory shift promotes security, accountability, and innovation in the integration of crypto services with traditional banking.

Description

The OCC, FDIC, and Federal Reserve have jointly affirmed that banks can custody cryptocurrencies, marking a significant regulatory milestone with strict consumer protection measures. While banks are empowered to hold

Latest News

- XRP Price Surge Possibly Driven by South Korean Buyers Amid Mixed Global Trading Activity2025-07-15 03:10:28

- China’s Q2 GDP Growth and PBOC Policies May Influence Bitcoin Valuations Amid Mixed Economic Signals2025-07-15 03:10:11

- LeBron Invests $3 Million to Acquire Over 600 Million PUMP Tokens in Strategic Crypto Move2025-07-15 02:58:39

- Binance Alpha Sees BR Token Leading Trading Volume Amid Market Fluctuation Warnings2025-07-15 02:37:46

- U.S. House to Vote on Bitcoin Market Structure and Stablecoin Bill This Week2025-07-15 02:26:23