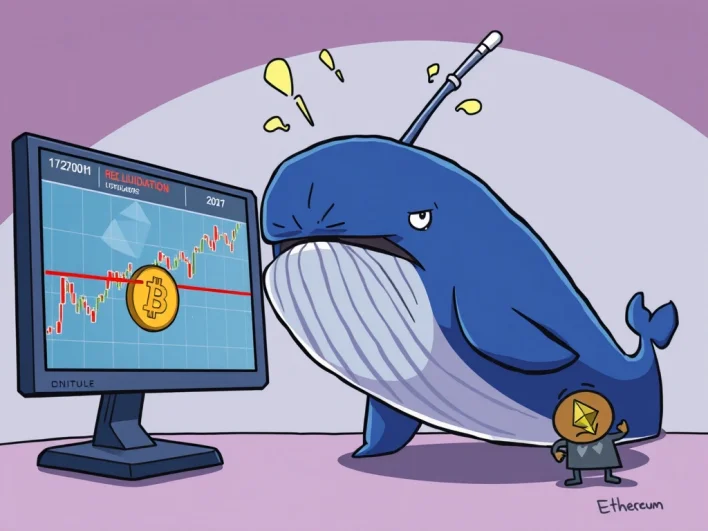

Urgent: Bitcoin Liquidation Looms for Hyperliquid Whale’s $115M BTC Short

Main Idea

A prominent investor on the Hyperliquid platform faces a potential $115 million Bitcoin short position liquidation, highlighting the risks of high-leverage crypto trading and the importance of on-chain data.

Key Points

1. A trader known as @qwatio has a $115 million BTC short position on Hyperliquid, at risk of liquidation if Bitcoin's price reaches $114,491.

2. Liquidation occurs when a trader's margin balance falls below the required maintenance level due to adverse price movements, leading to forced closure of the position.

3. Large liquidations like this can impact the broader market, drawing attention from analysts and traders monitoring on-chain data.

4. The situation underscores the high risks of leveraged crypto trading, emphasizing the need for risk management strategies such as diversification.

5. On-chain data plays a crucial role in tracking market activity and assessing trading risks in the transparent blockchain ecosystem.

Description

BitcoinWorld Urgent: Bitcoin Liquidation Looms for Hyperliquid Whale’s $115M BTC Short The crypto world holds its breath as a massive financial drama unfolds on the Hyperliquid platform. A prominent investor, known as @qwatio, faces the imminent threat of a substantial Bitcoin liquidation . This isn’t just any trade; it’s a staggering $115 million BTC short position , putting immense pressure on the market and the trader. Understanding the Hyperliquid Whale’s High-Stakes Bet What exactly is happ...

Latest News

- Bitcoin ETF Holdings: Brevan Howard’s Astounding $2.3 Billion Disclosure2025-08-15 15:31:05

- Deribit USDC Options: A Revolutionary Leap for Bitcoin and Ether Trading2025-08-15 14:33:16

- Retail Interest Surges: Why Investors Are Pivoting from Bitcoin to Altcoins and Ethereum2025-08-15 14:29:18

- Bybit’s Daily Treasure Hunt Returns with 220,000 USDT Prize Pool and Lower Entry Barriers2025-08-15 14:28:08

- Bitcoin Uptrend: Resilient Against US PPI Shocks2025-08-15 14:26:33