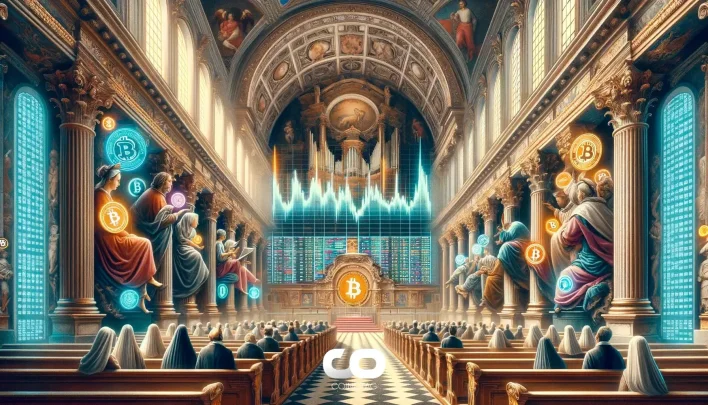

SEC Weighs Collateralization for BlackRock’s Ethereum ETF While Postponing Grayscale’s Litecoin ETF Verdict

Main Idea

The SEC is evaluating collateralization for BlackRock’s Ethereum ETF and has delayed the decision on Grayscale’s Litecoin ETF, reflecting heightened regulatory scrutiny and a focus on investor protection in the crypto ETF market.

Key Points

1. SEC is considering collateral backing for BlackRock’s Ethereum ETF to mitigate risks.

2. Grayscale’s Litecoin ETF decision is postponed due to extended regulatory review.

3. Collateralization in Ethereum ETFs involves securing assets to address market manipulation risks.

4. Stricter regulations may slow ETF launches but aim to improve market stability and investor protection.

5. The SEC’s actions highlight a regulatory shift toward stronger safeguards for crypto ETFs.

Description

Are You Chasing New Coins? Catch the newest crypto opportunities. Be the first to buy, be the first to win! Click here to discover new altcoins! The SEC is

Latest News

- Cold Wallet and Ethereum Among Top Crypto Coins Showing Potential for 2025 Gains2025-07-30 16:37:15

- Ethereum Shows Potential for Gains Amid Whale Accumulation and Key Support Levels2025-07-30 16:35:28

- White House Crypto Report May Exclude Recommendations on Federal Bitcoin Reserve Creation2025-07-30 16:33:02

- Whale Withdraws Additional 7,500 ETH from Binance Following Massive 20,000 ETH Transfer2025-07-30 16:31:53

- EigenDA V2 Launch on Ethereum Mainnet Could Enhance Rollup Throughput and Ecosystem Integration2025-07-30 16:31:07