Ray Dalio Suggests Considering 15% Bitcoin Allocation Amid US Debt Concerns and Currency Risks

Main Idea

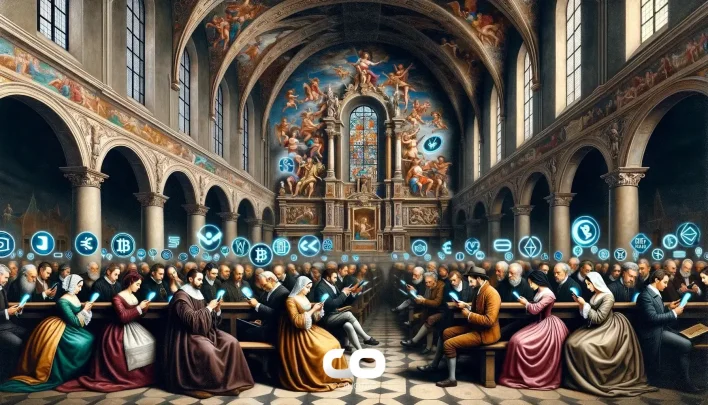

Ray Dalio recommends allocating 15% of investment portfolios to Bitcoin and gold to hedge against the US debt crisis and potential currency devaluation.

Key Points

1. Ray Dalio advises a 15% portfolio allocation to Bitcoin and gold, with the exact split left to individual investors.

2. The US Treasury report projects an additional $1 trillion in borrowing for Q3 and $590 billion for Q4, highlighting growing debt concerns.

3. Bitcoin and gold have reached new highs amid economic uncertainty, with Bitcoin trading near $118,100 and gold surging to multiple new highs.

4. Dalio remains skeptical about Bitcoin as a reserve currency due to its volatility and transaction limitations.

5. The recommendation is framed as a strategic move to protect investments against US debt risks and currency devaluation.

Description

Are You Chasing New Coins? Catch the newest crypto opportunities. Be the first to buy, be the first to win! Click here to discover new altcoins! Ray Dalio recommends

Latest News

- Ethereum Treasury Protocol Raises $46.5 Million, Potentially Influencing DeFi Staking and Capital Management2025-07-29 10:34:27

- Bubblemaps Flags Possible Suspicious Token Activity in Solana’s Rugproof Launchpad2025-07-29 10:33:18

- Alleged USDT Debt Sparks Kidnap Plot While London Gang Targets Bitcoin Misidentification2025-07-29 10:32:49

- Binance Introduces Discount Buy Offering Potential Bitcoin Purchases Below Market Price with APR Rewards2025-07-29 10:32:06

- Ethereum Price Alert: ETH Below $3,675 Triggers $1.97B Long Liquidations, Break Above $4,053 Sparks $1.35B Short Liquidations2025-07-29 10:31:38