Open Interest in XRP Options Nears $100M as High Volatility Draws Yield Hunters

2025-07-10 14:36:11

Main Idea

Open interest in XRP options has surged to nearly $100 million due to high volatility, with market sentiment turning bullish as traders capitalize on the token's price swings.

Key Points

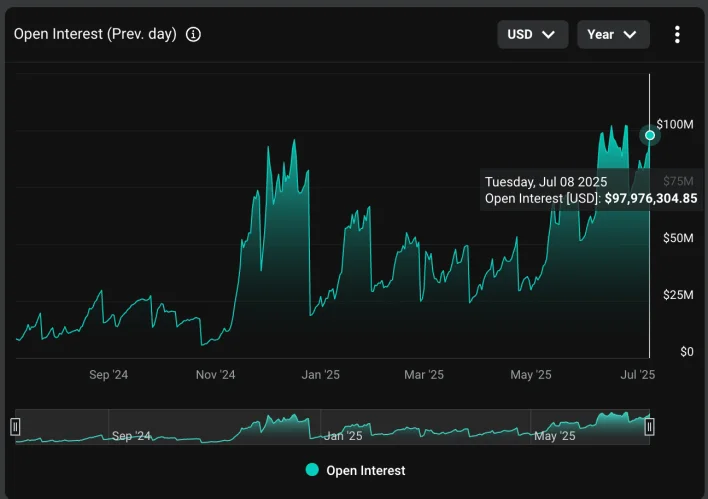

1. The notional open interest in XRP options on Deribit rose 38% in two weeks, reaching nearly $98 million, close to the June 24 record of $102.3 million.

2. XRP's implied volatility is higher than Bitcoin's, with the token delivering over 300% annual returns in the past 12 months.

3. Traders are profiting by selling cash-secured puts due to high implied volatility, and positive risk reversals indicate bullish sentiment.

4. More than 30 million call options are open compared to 11.92 million puts, resulting in a put-call ratio of 0.39.

Description

The dollar value locked in open XRP options contracts listed on Deribit is rapidly climbing to a record as the token's high implied volatility draws yield hunters. The so-called notional open interest (OI) has risen to nearly $98 million from $71 million since the June 27 quarterly expiry, a solid 38% rise in two weeks. It is now nearing the June 24 record of $102.3 million, according to data source Deribit Metrics . In contract terms, the OI has increased by 26% to 42,414. (The contract multipl...

Latest News

- MARA Holdings Names Ex-Blue River Exec as CPO to Lead Productization of Energy Tech2025-07-10 19:16:32

- Former Bitfury Exec Gould Confirmed to Take Over U.S. Banking Agency OCC2025-07-10 19:14:30

- BTC All-Time High Liveblog: Is This Run Different?2025-07-10 19:13:30

- Bitcoin Breaks Fresh Record Topping $113,0002025-07-10 17:38:15

- NEAR Protocol Gains 5% Amid Surge in Trading Volume2025-07-10 17:37:57