MiCA Regulation May Encourage Coinbase and Other Crypto Exchanges to Expand in Europe

2025-07-15 14:48:08

Main Idea

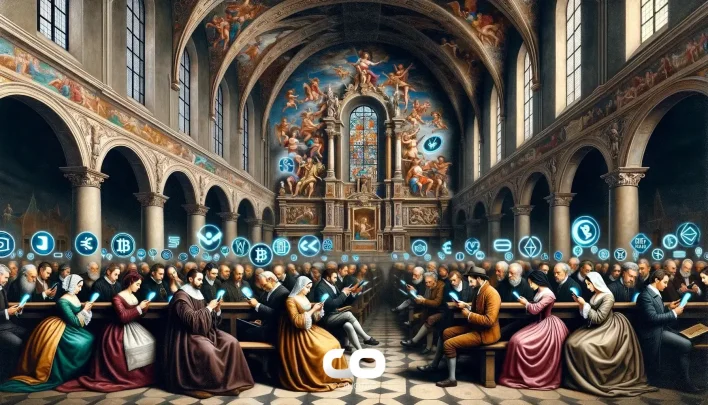

The MiCA regulation is strengthening Europe's crypto market by enhancing compliance, providing a competitive edge to crypto firms, and influencing global regulatory frameworks.

Key Points

1. MiCA compliance offers a strategic advantage for crypto firms by enforcing stricter Anti-Money Laundering (AML) protocols and fostering trust.

2. The regulation significantly impacts stablecoin issuers, with MiCA-approved stablecoins expected to enhance market stability.

3. MiCA introduces critical investor protections, enforcing stringent controls to safeguard against high-profile cases like FTX.

4. The synergy between MiCA and MiFID allows crypto exchanges to broaden their product portfolios under established financial regulations.

5. Major exchanges like Coinbase, OKX, and Bybit are adopting MiCA licenses, reflecting a broader industry movement toward compliance in Europe.

6. MiCA's influence is prompting other jurisdictions to consider similar frameworks, balancing innovation with investor protection.

Description

The EU’s Markets in Crypto-Assets (MiCA) regulation is reshaping the European crypto landscape by fostering compliance and boosting investor confidence. Since its implementation, MiCA has encouraged major exchanges to obtain

Latest News

- Bitcoin Top Traders Slightly Reduce Exposure Short Term While Maintaining Bullish Long-Term Outlook2025-07-16 22:43:02

- Trump Media Files AI Trademarks for Truth Social Amid Share Rally and Technology Expansion2025-07-16 22:42:44

- Euro-Backed Stablecoins Could Support Europe’s Financial Sovereignty Amid USD Dominance2025-07-16 22:42:18

- HYPE Could See Upward Momentum After Sonnet BioTherapeutics Launches $583M Hyperliquid Treasury2025-07-16 22:30:18

- Governments Consider Stricter Regulations on Bitcoin Donations Amid Election Transparency Concerns2025-07-16 22:16:53