Metaplanet Explores Using Bitcoin as Collateral in Phase Two of Corporate Finance Strategy

2025-07-09 01:49:41

Main Idea

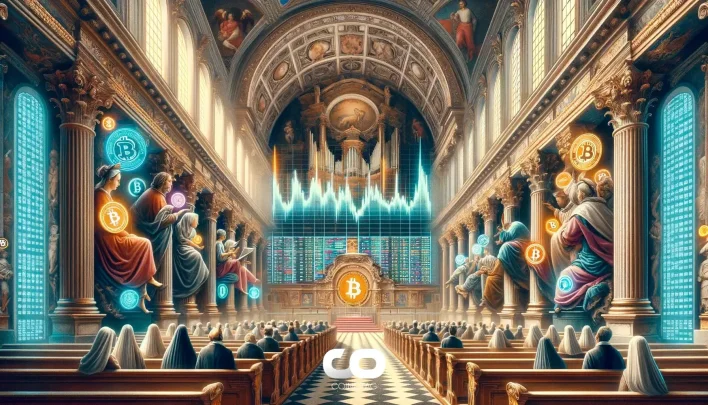

Metaplanet is advancing its Bitcoin strategy by planning to use BTC as collateral for corporate finance, aiming to increase its Bitcoin reserves to 210,000 BTC by 2027.

Key Points

1. Metaplanet, led by CEO Simon Gerovich, is entering the second phase of its Bitcoin strategy, focusing on using BTC as collateral.

2. The company currently holds 15,555 BTC and plans to increase its reserves to 210,000 BTC by 2027.

3. This move could redefine asset-backed lending and corporate treasury management, integrating Bitcoin into mainstream financial operations.

4. The strategy faces technological and regulatory challenges, requiring robust infrastructure and adaptable frameworks for digital asset-backed agreements.

5. CEO Simon Gerovich emphasizes the potential of Bitcoin-backed corporate lending to transform the crypto-financial ecosystem.

Description

Metaplanet has launched the second phase of its innovative Bitcoin strategy, utilizing BTC as collateral to enhance corporate financing capabilities in Japan. This strategic move underscores a growing trend where

Latest News

- SEC’s Updated ETF Process Could Accelerate Solana Crypto ETF Filings and Altcoin Fund Growth2025-07-09 04:35:38

- Solana Futures Volume May Surpass $4 Billion on CME Group Amid Growing Institutional Interest2025-07-09 04:22:34

- Ethereum Spot ETF Sees $46.63M Net Inflow, Extends 3-Day Winning Streak2025-07-09 04:22:12

- Bitcoin Media Coverage in Q2 Shows Polarized Narratives and Limited Reporting from Elite Financial Outlets2025-07-09 04:21:41

- Whale Swaps 55 BTC for 2,293.8 ETH in $5.96M Ethereum Trade, Holding 67.98 WBTC2025-07-09 04:10:49