JPMorgan Explores Potential to Allow Clients Borrowing Cash Against Bitcoin Collateral

Main Idea

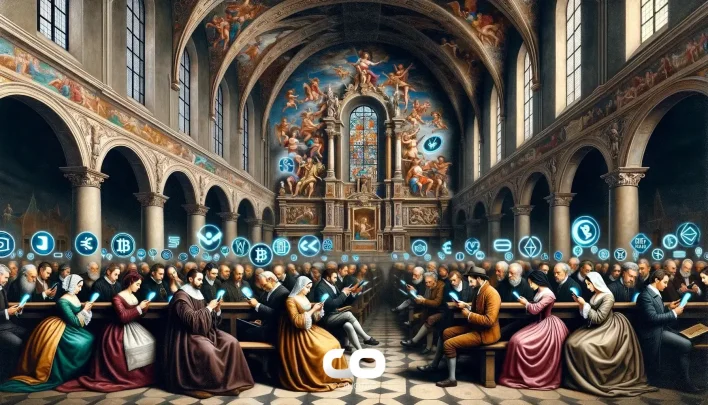

JPMorgan Chase is exploring the possibility of allowing clients to borrow cash against Bitcoin and Ethereum, marking a significant shift in its approach to cryptocurrency-backed lending and potentially reshaping the market.

Key Points

1. JPMorgan Chase is considering offering cash loans backed directly by Bitcoin and Ethereum, a departure from its previous preference for indirect crypto exposure through products like ETFs.

2. This move could tap into the growing demand for liquidity solutions among institutional clients and may encourage other banks to reconsider their crypto policies.

3. JPMorgan CEO Jamie Dimon has historically been skeptical of cryptocurrencies, but the bank's exploration of crypto-backed loans suggests a recognition of their increasing relevance in financial markets.

4. Competitors like Goldman Sachs and Morgan Stanley have not yet embraced direct crypto-backed lending, limiting their exposure to crypto-related financial products.

5. The adoption of crypto-backed loans by a major institution like JPMorgan could enhance market liquidity and signal a broader shift in the financial industry's approach to digital assets.

Description

Are You Chasing New Coins? Catch the newest crypto opportunities. Be the first to buy, be the first to win! Click here to discover new altcoins! JPMorgan is exploring

Latest News

- Genius Group Doubles Bitcoin Holdings to 200 BTC Amid Plans for 10,000 BTC Treasury Expansion2025-07-22 10:44:19

- SpaceX Moves $153 Million in Bitcoin After Three Years Amid Tesla Q2 Earnings Speculation2025-07-22 10:30:57

- TD Cowen Predicts MSTR Stock Surge as Bitcoin Holdings Reach 900,000 BTC by 20272025-07-22 10:28:57

- JPMorgan May Explore Bitcoin-Backed Loans as CEO Jamie Dimon Softens Crypto Stance2025-07-22 10:16:13

- Corporate Bitcoin Adoption May Increase as Firms Shift Treasury Strategies Toward BTC Reserves2025-07-22 10:14:15