James Wynn’s High-Leverage Bitcoin Bets Could Illustrate Risks of Short-Term Speculation

2025-07-12 22:00:09

Main Idea

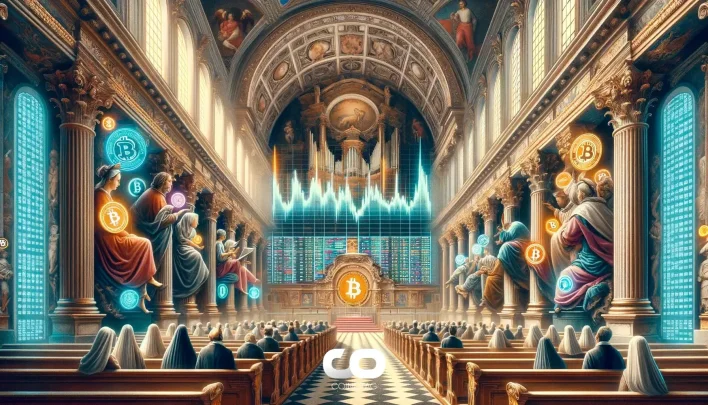

James Wynn’s high-leverage Bitcoin trades resulted in massive losses, highlighting the risks of speculative crypto trading and the dangers of short-term, high-risk strategies.

Key Points

1. James Wynn lost over $99 million due to high-leverage Bitcoin bets, including a $100 million long position liquidated after Bitcoin's price fell below $105,000.

2. Wynn reopened another $100 million Bitcoin position shortly after his initial loss, doubling down on his high-risk approach.

3. He used funds from at least 24 different addresses to bolster his account and liquidated 240 BTC to mitigate further losses.

4. Wynn’s trading collapse serves as a cautionary tale about the dangers of high-leverage crypto trading and the importance of risk management.

5. Long-term investors often cite Wynn’s losses as evidence supporting a buy-and-hold strategy over frequent, high-risk trades.

Description

James Wynn, a high-leverage crypto trader, has suffered catastrophic losses exceeding hundreds of millions of dollars due to risky short-term Bitcoin speculation. Following these losses, Wynn has deactivated his social

Latest News

- BONK Leads Cryptocurrency Spot Capital Inflows with $8.83 Million on July 132025-07-13 04:14:58

- Bitcoin’s Record Highs May Reflect Institutional Demand Despite Limited Retail Interest and Lower Search Trends2025-07-13 03:53:28

- Binance Alpha Trading Volume Hits $409 Million on July 12 with BR Leading at $198 Million2025-07-13 03:31:57

- Solana Shows Potential Uptrend With Institutional Accumulation and Fibonacci Targets Around $206 to $2652025-07-13 03:31:46

- Whale Buys 2,000 ETH on Cowswap Spending $5.9M USDC, Signals Major Ethereum Move2025-07-13 02:29:37