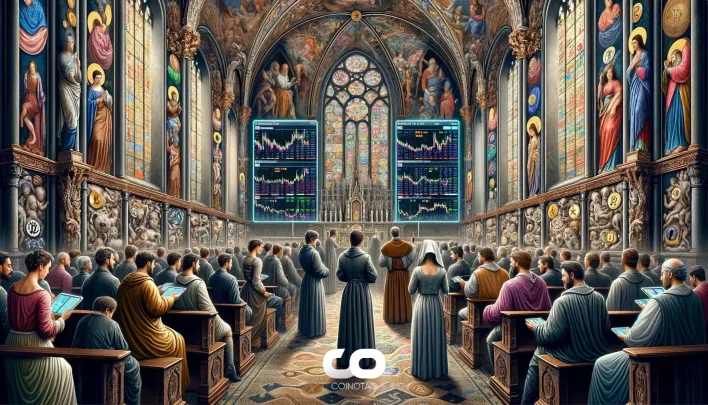

Grupo Murano Considers Building a $10 Billion Bitcoin Reserve as a Strategic Corporate Asset

Main Idea

Grupo Murano plans to build a $10 billion Bitcoin reserve to diversify assets and hedge against inflation, potentially setting a precedent for corporate Bitcoin adoption.

Key Points

1. Grupo Murano's $10 billion Bitcoin reserve plan involves phased accumulation and risk mitigation strategies, likely using dollar-cost averaging.

2. Bitcoin's fixed supply and decentralized nature offer a hedge against inflation and preserve purchasing power amid fiat currency devaluation risks.

3. Bitcoin's low correlation with traditional assets helps reduce overall portfolio risk for corporations.

4. Maintaining a Bitcoin reserve requires secure custody solutions and robust risk management due to regulatory uncertainties.

5. Grupo Murano's move could inspire other real estate firms and corporations to adopt Bitcoin as part of their treasury management strategies.

Description

Are You Chasing New Coins? Catch the newest crypto opportunities. Be the first to buy, be the first to win! Click here to discover new altcoins! Grupo Murano, a

Latest News

- Whale Deposits 300 BTC Worth $35.61M into Binance, Holding 800 BTC with $93.33M Profit2025-07-22 11:15:56

- Shiba Inu Burn Rate Surges Over 880% in 24 Hours, Indicating Potential Increased Community Activity2025-07-22 11:14:34

- Dogecoin Shows Signs of Potential Price Reversal Amid Overbought Technical Indicators2025-07-22 11:00:47

- XRP Technical Indicators Suggest Possible Rally Toward $6 by End of 20252025-07-22 11:00:28

- Ethereum Nears $4,200 Resistance as RSI Hits Cycle High Amid Growing Volume and Holder Confidence2025-07-22 10:59:55