GENIUS Act’s Yield Ban May Affect Digital Dollar Appeal Amid Rising Tokenized Money Market Funds

Main Idea

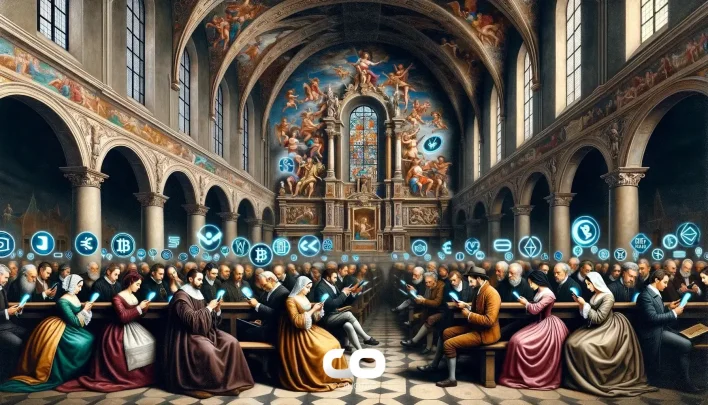

The GENIUS Act bans yield-bearing stablecoins, limiting their appeal compared to tokenized money market funds, which offer yield and regulatory oversight.

Key Points

1. The GENIUS Act prohibits stablecoin issuers from offering yield, impacting investor returns and reducing the competitive edge of stablecoins against traditional money market funds (MMFs).

2. Tokenized MMFs are emerging as an alternative to stablecoins, combining regulatory oversight with the ability to offer yield, as highlighted by industry experts like Temujin Louie and Paul Brody.

3. The banking sector influenced the GENIUS Act's yield ban due to concerns that yield-bearing stablecoins could attract depositors away from traditional banks.

4. Despite the ban, yield-bearing digital assets like YLDS (a yield-bearing stablecoin) have been approved, demonstrating that some forms of yield-bearing tokens can still exist under regulatory frameworks.

5. The GENIUS Act's restrictions reshape the DeFi landscape, pushing innovation toward tokenized MMFs and other compliant yield-generating products.

Description

Are You Chasing New Coins? Catch the newest crypto opportunities. Be the first to buy, be the first to win! Click here to discover new altcoins! The GENIUS Act

Latest News

- Grayscale Reappoints Barry Silbert as Chairman Amid Efforts to Strengthen Bitcoin ETF Leadership2025-08-04 22:49:02

- Solana Mobile’s Seeker Phone Could Generate $67.5 Million Amid Decentralized App Store Expansion2025-08-04 22:33:27

- Sequans Increases Bitcoin Holdings to 3,157 BTC, Signaling Potential Shift in Corporate Treasury Strategy2025-08-04 22:22:10

- Hedera Price Sees Uptick After Robinhood Listing While Polkadot Holds Support Amid Market Volatility2025-08-04 22:20:57

- Hyper Leads with Highest Win Rate, Building $10.16M Long Position in ETH2025-08-04 21:53:51