Fundamental Global’s $200M Ether Treasury Plan May Influence Market Despite Share Price Drop

Main Idea

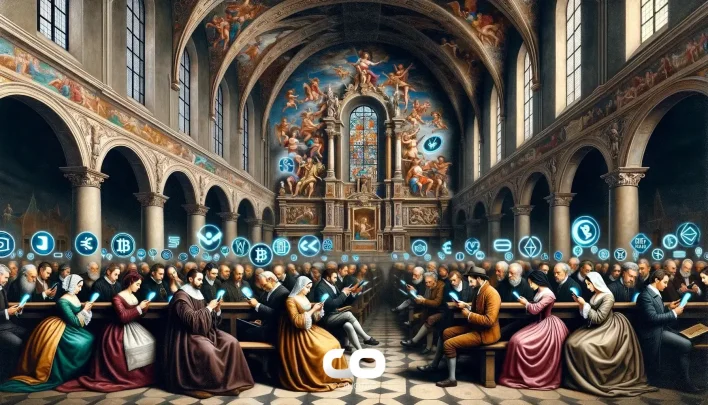

Fundamental Global (FG Nexus) announced a $200 million Ether (ETH) treasury plan, funded by issuing stock warrants, but its shares dropped 13.7% on the announcement day. The move reflects a growing trend of companies holding ETH for staking rewards and exposure to tokenized assets.

Key Points

1. Fundamental Global allocated $200 million to ETH as its primary treasury asset, funded by issuing 40 million common stock warrants at $5 each.

2. The company expects value from staking rewards and tokenized real-world asset exposure, beyond ETH price gains.

3. Despite the plan, FG Nexus's shares fell 13.7% on the announcement day, indicating investor caution.

4. Corporate ETH holdings are rising, with firms like BitMine Immersion Technologies and SharpLink holding significant amounts.

5. Ether Machine's recent $56.9 million ETH purchase aligns with Ethereum's 10-year milestone, reflecting institutional confidence.

Description

Are You Chasing New Coins? Catch the newest crypto opportunities. Be the first to buy, be the first to win! Click here to discover new altcoins! Fundamental Global has

Latest News

- Publicly-Listed Companies’ Bitcoin Investments Could Signal Strategic Shift in Corporate Treasury Management2025-07-31 17:16:46

- SEC Chair Proposes Crypto Custody and Trading Changes, Potentially Impacting Bitcoin Integration2025-07-31 17:16:26

- SEC’s Project Crypto May Influence Ethereum Regulation Amid U.S. Market Modernization Efforts2025-07-31 17:15:09

- Ethereum Shows Signs of Potential Strength Amid Post-FOMC Market Rotation and Smart Money Activity2025-07-31 17:14:03

- Bitcoin Profit-Taking by New Whales May Signal Declining Dominance and Potential Altcoin Season2025-07-31 16:56:34