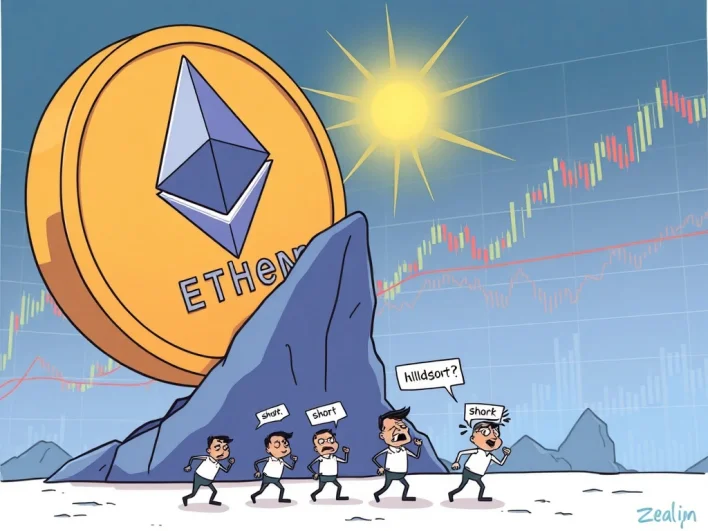

Ethereum Short Liquidation: An Explosive $1.66 Billion at Risk if ETH Hits All-Time High

Main Idea

A potential $1.66 billion in Ethereum short liquidation positions could be triggered if ETH reaches a new all-time high, with significant implications for the cryptocurrency market.

Key Points

1. Ethereum (ETH) is currently just 3% below its previous all-time high (ATH), creating anticipation and concern among traders.

2. Short liquidation occurs when traders betting on ETH's price decline are forced to buy back ETH at higher prices, potentially driving the price up further.

3. A new ETH ATH could have a cascading effect on the broader crypto market, influencing altcoin performance and market dynamics.

4. Market volatility and external factors could still delay or prevent ETH from reaching a new ATH, despite bullish indicators.

5. Ethereum's price movements are often correlated with Bitcoin's, adding another layer of complexity to market predictions.

Description

BitcoinWorld Ethereum Short Liquidation: An Explosive $1.66 Billion at Risk if ETH Hits All-Time High The cryptocurrency world is buzzing with anticipation as Ethereum (ETH) stands on the precipice of a significant market event. According to prominent Bitcoin investor and analyst Lark Davis, a staggering $1.66 billion in Ethereum short liquidation positions could face closure if ETH reaches a new all-time high (ATH). This isn’t just a minor blip; it’s a situation with the potential for explosive...

Latest News

- Bitcoin ETF Holdings: Brevan Howard’s Astounding $2.3 Billion Disclosure2025-08-15 15:31:05

- Deribit USDC Options: A Revolutionary Leap for Bitcoin and Ether Trading2025-08-15 14:33:16

- Retail Interest Surges: Why Investors Are Pivoting from Bitcoin to Altcoins and Ethereum2025-08-15 14:29:18

- Bybit’s Daily Treasure Hunt Returns with 220,000 USDT Prize Pool and Lower Entry Barriers2025-08-15 14:28:08

- Bitcoin Uptrend: Resilient Against US PPI Shocks2025-08-15 14:26:33