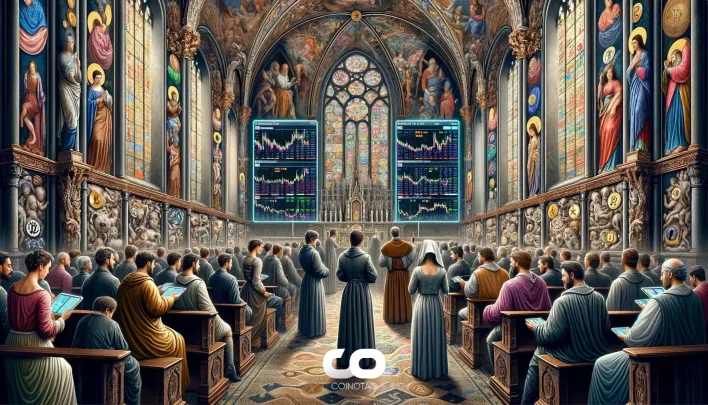

Ethereum Faces Possible Correction Amid Strong Performance and Divergent Analyst Views

Main Idea

Ethereum's strong performance raises questions about a potential correction, with analysts divided on short-term volatility versus long-term growth prospects.

Key Points

1. Ethereum has outperformed Bitcoin recently, driven by demand for dApps, NFTs, and DeFi, as well as anticipation of upcoming upgrades and favorable altcoin market dynamics.

2. Technical indicators like the Relative Strength Index (RSI) suggest a potential corrective phase, with profit-taking and macroeconomic challenges adding to caution.

3. Bullish analysts highlight Ethereum's transition to Proof-of-Stake and upcoming upgrades like EIP-4844 as factors supporting long-term growth despite short-term volatility.

4. Investors are advised to conduct thorough research, use dollar-cost averaging (DCA), and consider partial profit-taking to navigate potential market fluctuations.

5. Ethereum's long-term outlook remains promising, with network advancements expected to mitigate significant declines even if a correction occurs.

Description

Are You Chasing New Coins? Catch the newest crypto opportunities. Be the first to buy, be the first to win! Click here to discover new altcoins! Ethereum’s recent surge

Latest News

- Smart Money Shifts from Solana to $17.9M 3x Long Ethereum Position on Hyperliquid2025-07-23 05:45:35

- Ethereum ETF Inflows Suggest Potential Outperformance Over Bitcoin Amid Rising Institutional Interest2025-07-23 05:41:07

- DigitalX Increases Bitcoin Holdings Near 500 BTC, Suggesting Continued Accumulation Strategy2025-07-23 05:29:49

- UPBIT LISTING: Maintenance KRW 마켓 서버 점검 안내 (7/31 00:00 )2025-07-23 05:16:12

- 21Shares Files for ONDO ETF, Potentially Bridging Real-World Assets and DeFi in U.S. Markets2025-07-23 05:14:33