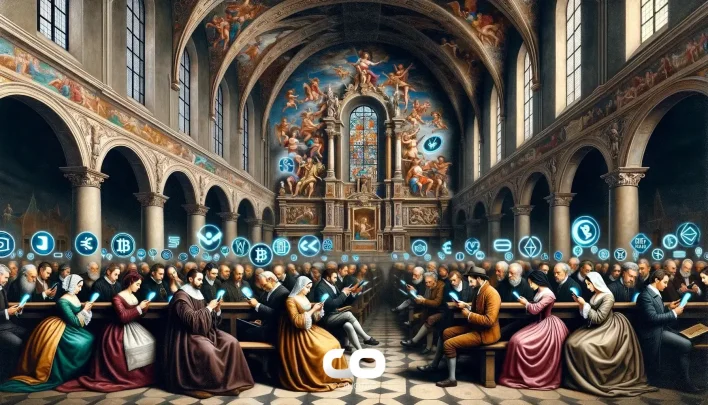

Ethereum Demand May Rise Amid Stablecoin Growth, Real-World Asset Tokenization, and Institutional Interest

Main Idea

Ethereum's demand is increasing due to stablecoin growth, real-world asset tokenization, institutional adoption via ETFs, and regulatory advancements like the GENIUS Act.

Key Points

1. Stablecoins like USDT and USDC are driving demand for Ethereum due to its robust security and smart contract capabilities.

2. Tokenization of real-world assets (RWA) on Ethereum is enhancing liquidity and access to traditionally illiquid markets.

3. Spot ETH ETFs are attracting institutional investors, boosting Ethereum demand without requiring direct custody of the asset.

4. The proposed GENIUS Act aims to federally recognize stablecoins, providing regulatory clarity and fostering innovation on Ethereum.

5. Upcoming network upgrades, such as Dencun, are expected to support Ethereum's long-term growth and adoption.

Description

Are You Chasing New Coins? Catch the newest crypto opportunities. Be the first to buy, be the first to win! Click here to discover new altcoins! Ethereum’s demand is

Latest News

- Dave Portnoy Reflects on Missed XRP Gains Following Unexpected Sale Amid Market Developments2025-07-21 19:28:16

- Ethereum Shows Potential for New Highs Amid Altcoin Rally as Bitcoin Momentum Slows2025-07-21 19:15:10

- Binance Altcoin Futures Volume Hits $100.7 Billion, Indicating Possible Market Shift2025-07-21 19:01:30

- Hedera Plans Mainnet Upgrade to Version 0.63 With Potential Network Delays, HBAR Price Impact Uncertain2025-07-21 19:00:59

- Ripple Moves Over 210 Million XRP Between Internal Wallets Amid Market Speculation2025-07-21 18:59:11