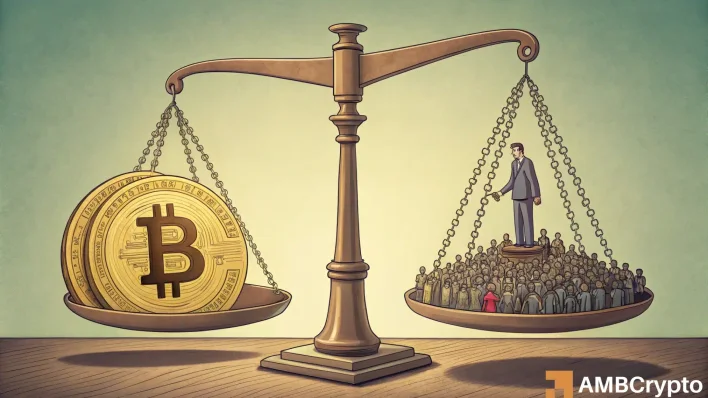

Decoding Bitcoin’s rising divide – Retail sells, whales buy $600M in BTC

Main Idea

Retail investors are selling Bitcoin to lock in profits during its rally, while whales are accumulating over $600 million in crypto, indicating a divergence in market behavior.

Key Points

1. Retail inflows to Binance surged from $12 billion to over $16 billion, suggesting widespread profit-taking by retail investors.

2. Binance’s Net Taker Volume turned sharply negative, plunging below -$60 million, indicating retail sell-off.

3. Whales have withdrawn over $600 million in crypto from centralized exchanges, including $400 million in ETH and $200 million in BTC, signaling accumulation.

4. The divergence between retail selling and whale accumulation suggests a widening gap in market confidence and strategy.

5. Historical data shows retail traders often exit early during rallies, missing further gains, while whales may anticipate long-term bullish trends.

Description

Over $16 billion in retail inflows hit Binance as whales quietly withdraw $600 million in crypto.

Latest News

- Kaspa [KAS] soars 13% – But THIS resistance zone signals caution!2025-07-22 16:13:37

- Michael Saylor’s Strategy IPO could raise $500M for Bitcoin – Here’s how2025-07-22 15:32:01

- PUMP token falls 40% since launch – Is a price recovery in sight?2025-07-22 14:09:44

- Solana’s $200 test – Traders, can SOL hold on, if so, what next?2025-07-22 13:16:51

- ‘Sell Ethereum, buy Bitcoin’ – Will Peter Schiff be right this time?2025-07-22 11:16:50