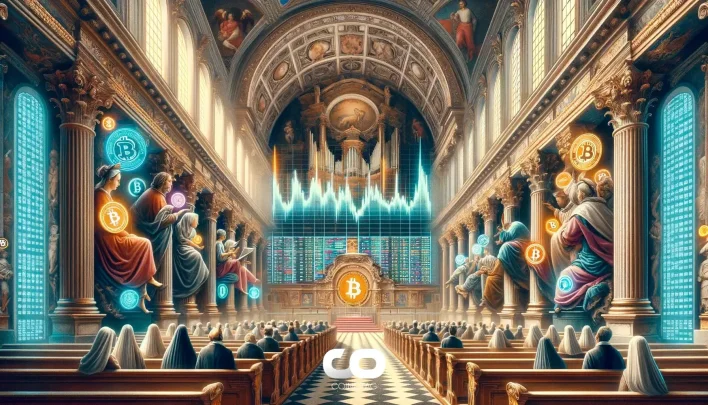

Curve Finance’s Yield Basis Could Potentially Mitigate Bitcoin Impermanent Loss for DeFi Liquidity Providers

Main Idea

Curve Finance's Yield Basis protocol mitigates impermanent loss for Bitcoin and Ether liquidity providers by maintaining a 200% overcollateralized position using borrowed crvUSD stablecoins, while also managing token inflation and emissions.

Key Points

1. Yield Basis eliminates impermanent loss for BTC and ETH liquidity providers by ensuring a 200% overcollateralized position with crvUSD.

2. The protocol uses compounding leverage to maintain precise collateralization, as explained by Curve founder Dr. Michael Egorov.

3. Yield Basis allows yield to be denominated in either Bitcoin or YB tokens, balancing inflation and sustaining user confidence in DeFi.

4. The market-based approach to inflation helps maintain token value stability and supports sustainable growth in DeFi liquidity provisioning.

5. Yield Basis enhances liquidity depth and market efficiency within the Curve Finance ecosystem by offering flexible yield options.

Description

Are You Chasing New Coins? Catch the newest crypto opportunities. Be the first to buy, be the first to win! Click here to discover new altcoins! Yield Basis is

Latest News

- XRP Maintains Bullish Structure as Market Awaits Daily Close Above $3.12 for Confirmation2025-08-02 23:37:46

- Bitcoin Shows Potential for Further Growth Amid Market Maturity and Short-Term Holder Volatility2025-08-02 23:25:38

- Ethereum Whale’s Increased 20,000 ETH Short Position May Influence Market Volatility2025-08-02 23:25:20

- Bitcoin Shows Potential for Breakout Toward $121,000 Resistance Amid Strong Volume and Momentum2025-08-02 23:13:52

- Arkham Intelligence Suggests LuBian Bitcoin Hack May Be Largest Crypto Heist Unreported for Years2025-08-02 22:47:24