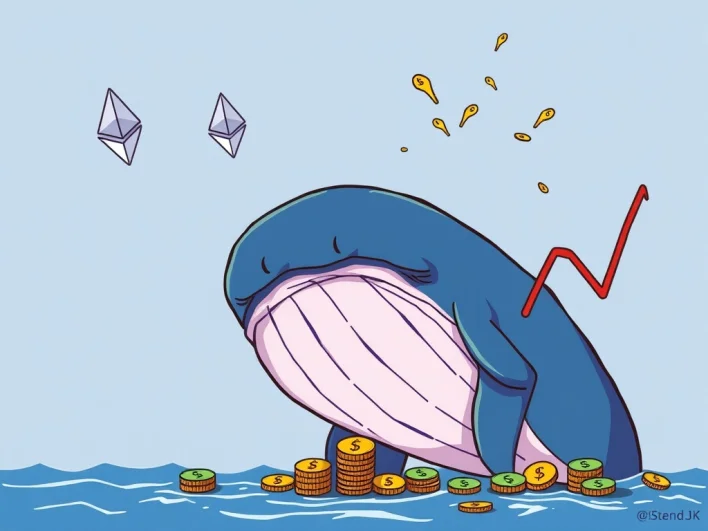

Crypto Whale’s Shocking $3 Million Loss After $29 Million Ethereum Trading Gains Vanish

Main Idea

A crypto whale's $3 million investment grew to $29 million but was completely lost due to aggressive trading and high leverage, highlighting the risks of high-stakes cryptocurrency trading.

Key Points

1. A trader known as @qwatio on X (formerly Twitter) initially turned a $3 million investment into $29 million through skilled trading.

2. The trader's aggressive short positions on Ethereum (ETH) led to significant losses due to market volatility and high leverage.

3. Overconfidence and the use of borrowed funds amplified both gains and losses, culminating in a $475,000 liquidation on the decentralized derivatives protocol GMX.

4. On-chain analysis provides real-time, immutable records of trading activities, offering insights for risk management.

5. Key takeaways for traders include managing risk, avoiding over-leverage, and diversifying portfolios to mitigate losses in volatile markets.

Description

BitcoinWorld Crypto Whale’s Shocking $3 Million Loss After $29 Million Ethereum Trading Gains Vanish The cryptocurrency world often highlights incredible gains, but a recent event involving a prominent crypto whale serves as a stark reminder of the inherent risks. This story unfolds a dramatic reversal of fortune, where an initial $3 million investment, which ballooned into $29 million, was completely wiped out. This significant loss, primarily due to aggressive Ethereum trading strategies, unde...

Latest News

- Bitcoin ETF Holdings: Brevan Howard’s Astounding $2.3 Billion Disclosure2025-08-15 15:31:05

- Deribit USDC Options: A Revolutionary Leap for Bitcoin and Ether Trading2025-08-15 14:33:16

- Retail Interest Surges: Why Investors Are Pivoting from Bitcoin to Altcoins and Ethereum2025-08-15 14:29:18

- Bybit’s Daily Treasure Hunt Returns with 220,000 USDT Prize Pool and Lower Entry Barriers2025-08-15 14:28:08

- Bitcoin Uptrend: Resilient Against US PPI Shocks2025-08-15 14:26:33