Crucial Fed Rate Decisions: Powell’s Bold Stance on Future Cuts

Main Idea

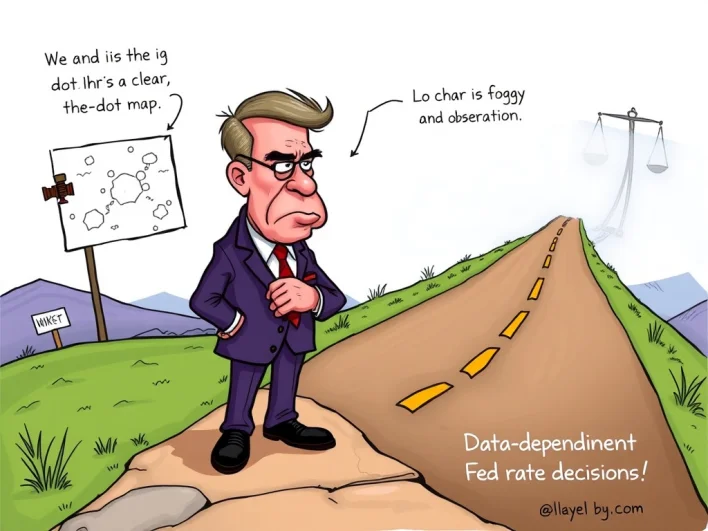

Federal Reserve Chair Jerome Powell emphasized that future Fed rate decisions will be data-dependent, not guided by the June dot plot projections, highlighting a flexible and evolving approach to monetary policy.

Key Points

1. Jerome Powell stated that the June dot plot, which hinted at two rate cuts in 2025, will not dictate future Fed rate decisions.

2. The Fed's approach is data-dependent, focusing on key economic indicators like inflation, labor market reports, GDP growth, and consumer spending.

3. Higher interest rates or the expectation of prolonged high rates can negatively impact the crypto market by reducing liquidity and investor risk appetite.

4. Investors should monitor inflation data (CPI, PCE), labor market reports, GDP growth, and consumer spending for clues on future Fed rate decisions.

5. The dot plot remains relevant as it reflects FOMC members' current views but is not a definitive policy guide; decisions will be based on actual economic data.

Description

BitcoinWorld Crucial Fed Rate Decisions: Powell’s Bold Stance on Future Cuts In the dynamic world of finance, every word from central bank leaders carries immense weight, especially for those navigating the volatile waters of cryptocurrency. Recently, Federal Reserve Chair Jerome Powell delivered a pivotal statement, clarifying that the much-discussed June dot plot, which had hinted at two rate cuts in 2025, will not be the guiding star for future Fed rate decisions . This declaration has sent r...

Latest News

- Ethereum Active Addresses Surge to Astounding Two-Year High2025-07-31 16:24:04

- SOL Long Position: Unveiling an Astounding $42.3M Crypto Whale Bet2025-07-31 16:23:45

- Unveiling the Crucial 90-Day Extension of the US Mexico Trade Deal2025-07-31 16:00:45

- Blockchain Encryption: Naoris Unveils a Daring $120K Challenge to Test Its Unbreakable Security2025-07-31 15:35:00

- OpenAI’s Bold European Leap: First AI Data Center Arrives in Norway2025-07-31 15:32:20