Bitcoin Options: Unveiling Why a $200K Rally Isn’t Expected by Year-End

Main Idea

The article discusses the upcoming $8.8 billion Bitcoin options expiry on December 26, highlighting why a $200K Bitcoin rally by year-end is unlikely despite high open interest in call options.

Key Points

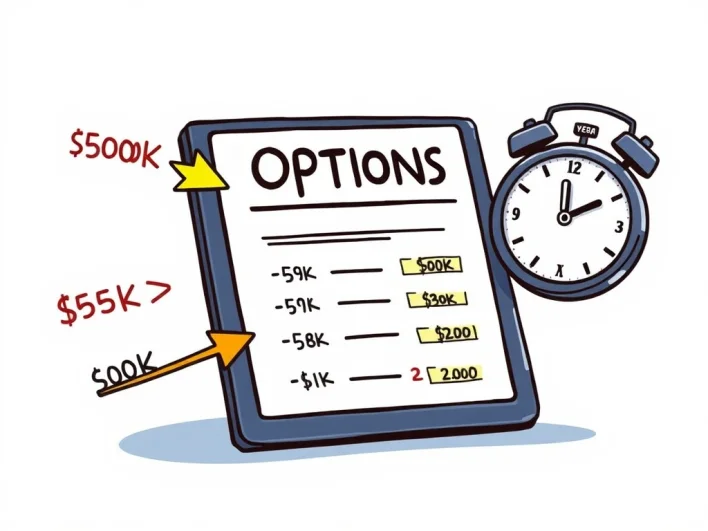

1. A significant $8.8 billion Bitcoin options expiry is set for December 26, with over $1 billion tied to the $200,000 strike price.

2. Open interest shows a bullish skew with $6.45 billion in call options versus $2.36 billion in put options, but many are far-out-of-the-money (OTM) calls used for low-risk, leveraged bets.

3. Traders are hedging against potential price drops, with approximately $900 million in put options indicating caution.

4. The options market is priced for stability within a certain range, suggesting no massive price shock is expected unless new catalysts emerge.

5. Far-out-of-the-money calls are speculative bets unlikely to result in actual $200K Bitcoin prices by year-end.

Description

BitcoinWorld Bitcoin Options: Unveiling Why a $200K Rally Isn’t Expected by Year-End The cryptocurrency world is abuzz as traders gear up for a monumental event: the impending $8.8 billion Bitcoin options expiry on December 26. This isn’t just another date on the calendar; it’s a critical moment offering deep insights into the immediate future of BTC expiry and broader market expectations. While some might dream of parabolic price surges, current data suggests a more grounded reality. Understand...

Latest News

- Bitcoin ETF Holdings: Brevan Howard’s Astounding $2.3 Billion Disclosure2025-08-15 15:31:05

- Deribit USDC Options: A Revolutionary Leap for Bitcoin and Ether Trading2025-08-15 14:33:16

- Retail Interest Surges: Why Investors Are Pivoting from Bitcoin to Altcoins and Ethereum2025-08-15 14:29:18

- Bybit’s Daily Treasure Hunt Returns with 220,000 USDT Prize Pool and Lower Entry Barriers2025-08-15 14:28:08

- Bitcoin Uptrend: Resilient Against US PPI Shocks2025-08-15 14:26:33