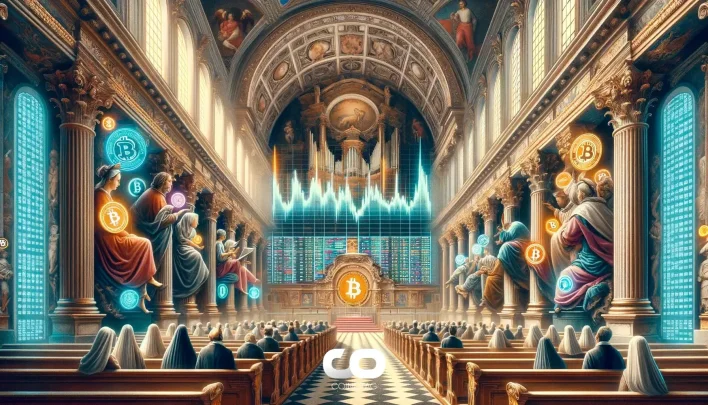

Bitcoin Lending: DeFi’s User Experience and Collateral Range May Offer Advantages Over TradFi

Main Idea

JPMorgan’s entry into crypto lending intensifies competition with DeFi, which offers advantages like diverse collateral options, dynamic fee structures, and permissionless access, while institutional involvement signals market maturation.

Key Points

1. DeFi’s liquidation mechanisms and dynamic fee structures often result in lower costs for borrowers, enhancing accessibility.

2. DeFi’s permissionless access and composability are core strengths, allowing broader user participation and protocol interoperability.

3. JPMorgan’s move into crypto-backed lending is seen as a validation of the digital asset ecosystem, bringing enhanced liquidity and market maturation.

4. Experts caution that TradFi’s approach may be reactive and face regulatory constraints, while DeFi remains agile and open.

5. The interplay between TradFi and DeFi will shape the future of crypto lending, with both serving distinct market segments.

Description

Are You Chasing New Coins? Catch the newest crypto opportunities. Be the first to buy, be the first to win! Click here to discover new altcoins! As JPMorgan explores

Latest News

- FUZZY PANDA SHORT RCAT2025-08-15 14:32:02

- OPENDOOR ANNOUNCES CEO SEARCH2025-08-15 13:03:49

- $USELESS listed on Binance futures2025-08-15 10:49:47

- BERKSHIRE HATHAWAY ADDS UNH, NUE, LEN, DHI, LAMR IN 2Q: 13F2025-08-14 20:18:07

- Lido Co-founder: Plans to use stETH to repurchase LDO mechanism, final repurchase plan to be determined by the end of the year2025-08-14 15:12:41