Bitcoin CEX Balances: Astounding 9K BTC Shift Signals Investor Confidence

Main Idea

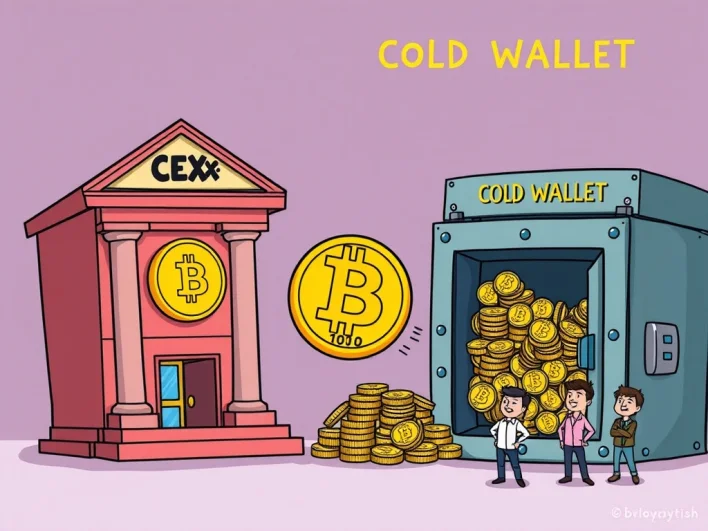

Approximately 9,000 Bitcoin (BTC) were moved off centralized exchanges (CEXs) in late July, signaling increased investor confidence and a shift towards self-custody via cold wallets.

Key Points

1. Bitcoin CEX balances saw a notable decline of around 9,000 BTC in late July, as reported by Sentora.

2. Centralized exchanges hold a significant portion of circulating Bitcoin, making their balances a key market activity indicator.

3. Investors are moving BTC to cold wallets due to heightened security awareness and desire for control over private keys.

4. This outflow reduces immediate selling pressure and affects the perceived available BTC supply, potentially benefiting long-term holders.

5. The trend reflects positive investor sentiment towards self-custody and may impact market stability by altering BTC supply distribution.

Description

BitcoinWorld Bitcoin CEX Balances: Astounding 9K BTC Shift Signals Investor Confidence The cryptocurrency world constantly shifts, and recent data has highlighted a significant movement: Bitcoin CEX balances experienced a notable decline. In the final week of July, approximately 9,000 Bitcoin (BTC) moved off centralized exchanges (CEXs). This substantial crypto exchange outflow , as reported by Sentora (formerly Into The Block), primarily saw these valuable digital assets transferred into secure...

Latest News

- Bitcoin ETF Holdings: Brevan Howard’s Astounding $2.3 Billion Disclosure2025-08-15 15:31:05

- Deribit USDC Options: A Revolutionary Leap for Bitcoin and Ether Trading2025-08-15 14:33:16

- Retail Interest Surges: Why Investors Are Pivoting from Bitcoin to Altcoins and Ethereum2025-08-15 14:29:18

- Bybit’s Daily Treasure Hunt Returns with 220,000 USDT Prize Pool and Lower Entry Barriers2025-08-15 14:28:08

- Bitcoin Uptrend: Resilient Against US PPI Shocks2025-08-15 14:26:33