Bitcoin and Crypto Tokens: Potential Paths for Revival Amid Regulatory and Structural Changes

Main Idea

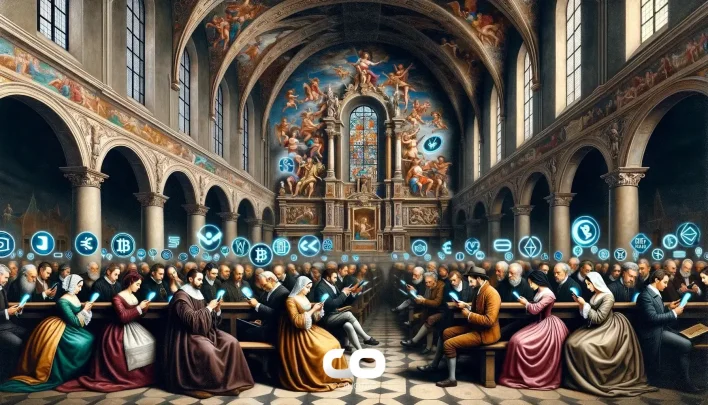

Emerging regulations and tokenized real-world assets are paving the way for a potential revival in the Bitcoin and crypto token markets, despite past issues with regulatory flaws and tokenomics.

Key Points

1. Regulatory frameworks like the EU’s MiCA are enabling transparent and fair token revival by introducing clear rules that protect investors.

2. Tokenized real-world assets (RWAs), such as equities and bonds, are becoming increasingly accessible to crypto investors, requiring robust legal frameworks.

3. The misunderstanding of token utility by investors, such as staking or liquidity provision, has contributed to past market issues.

4. Governments and major financial institutions are actively supporting the integration of RWAs into the crypto market.

5. Retail investors can anticipate broader access to high-quality tokens and tokenized assets, fostering a healthier investment ecosystem.

Description

Are You Chasing New Coins? Catch the newest crypto opportunities. Be the first to buy, be the first to win! Click here to discover new altcoins! Crypto tokens failed

Latest News

- Trump Media’s “Truth” Token Plan May Leverage Bitcoin Holdings to Enhance Subscription Payments and Wallet Services2025-08-03 16:53:51

- Ethereum Whales Possibly Increasing Holdings Amid Rising On-Chain Activity and Institutional Interest2025-08-03 16:28:00

- Justin Sun Propels TRON into the Future with Historic Chinese-Born Space Flight and Interstellar Economic Plan2025-08-03 16:26:04

- Solana Leads with 22.24 Million Active Addresses Among Top Public Chains, Says Nansen Data2025-08-03 16:12:20

- XRP Ledger Updates and Price Correction: Potential Impacts Amid Market Uncertainty2025-08-03 16:11:48